Managerial accounting is only concerned with the value these items have on a company’s productivity. Managers gather management accounting data and analyze, process, interpret, and communicate the results so that the information can be used to promote sound internal decision-making. This type of analysis helps management to evaluate how effective they were at carrying out the plans and meeting the goals of the corporation. You will see many examples of reports and analyses that can be used as tools to help management make decisions. Financial accounting primarily focuses on the outcome of generating a profit, not the overall system. If you want to learn more about financial accounting vs. managerial accounting and have some of the most common questions answered, such as “Is managerial accounting more difficult than financial accounting?

Managerial Accounting Types of Reports and Tools

Creating interim financial reports (quarterly or half-yearly statements) is a part of standard financial accounting processes that provide timely updates on a company’s performance. These reports are particularly used for investors and management as they help former managers allege pervasive inventory fraud at walmart how deep does the rot go them monitor short-term financial performance, spot potential issues, and make necessary strategic decisions before the end of the fiscal year. The cash flow statement is also an important financial statement used in both financial and managerial accounting.

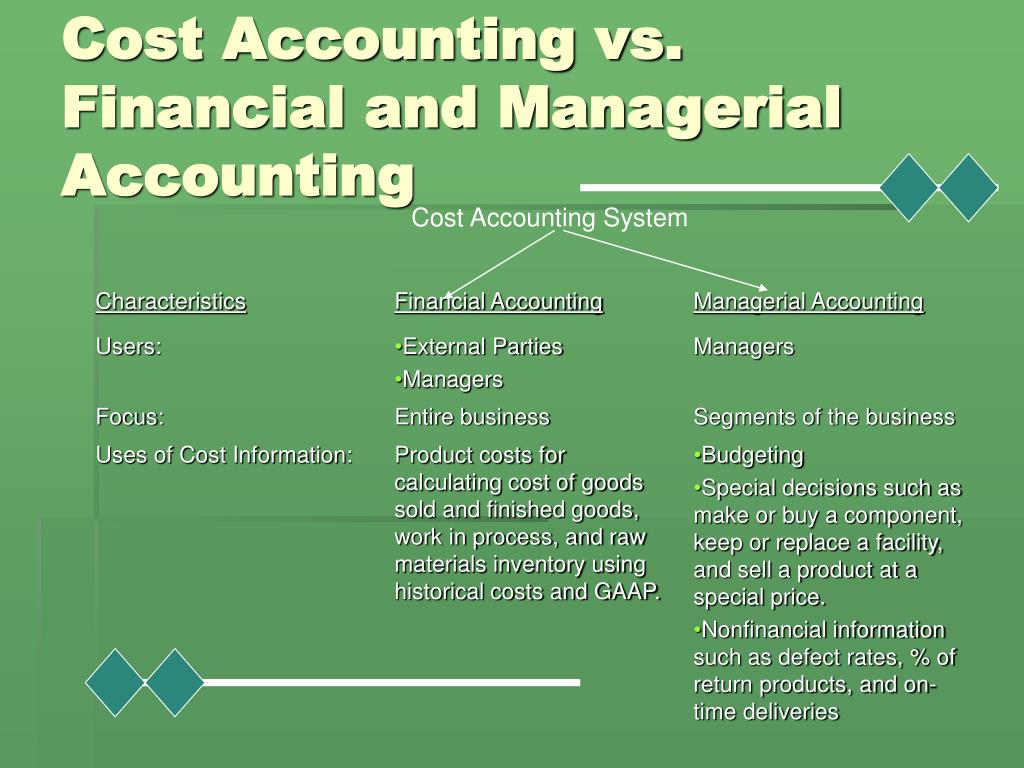

Managerial Accounting vs. Financial Accounting

Because managerial accounting is not for external users, it can be modified to meet the timely specific needs of its intended users. The key differences between managerial accounting and financial accounting relate to the intended users of the information. Accounting provides a snapshot of an organization’s financial situation using past and present transactional data, while finance is inherently forward-looking; all value comes from the future. While both are related to the administration and management of an organization’s assets, each contains major differences in scope and focus. When it comes to evaluating and strategizing the financial health of your company or department, it’s important to have a working knowledge of both disciplines. Management accounting refers to accounting information developed for managers within an organization.

Managerial Accounting vs Financial Accounting: Reporting Conventions

Also, operational reports can have a very limited distribution, with some reports only going to one person — whoever is responsible for the area or cost being reported on. Financial accounting reports are distributed inside and outside of a business and are governed by GAAP and IFRS. The external publication of financial statement makes it very necessary to follow regulation to provide correct information. The perception that more training is required for financial accounting might be reflected in the higher pay rates of financial accountants over managerial accountants.

It is used to create reports that help the management with planning, budgeting, and performance evaluation and is not to be submitted as official documents for government filings. Managerial accounting is fundamentally a forward-looking concept designed to provide data to help a business prepare for the future. It involves forecasting sales and revenue to anticipate potential costs, risks, and opportunities a company might face. However, these can also include scenario and sensitivity analyses that explore different hypothetical situations to understand their potential impact on the business. This can help an organization develop contingency plans and allocate resources accordingly to meet its long-term goals.

Does Managerial Accounting Follow GAAP?

- There are many short, helpful videos that explain various concepts of managerial accounting.

- Managerial accounting reports are usually designed for a specific decision and provide information for relatively short periods of time.

- Managerial accounting has a more specific focus, and the information is more detailed and timelier.

- In financial accounting, you need to follow GAAP accounting principles, making it more structured.

- The two accounting systems are part of the total business system and, for this reason, they normally overlap.

In financial accounting, costs are usually recorded as expenses but not with the same level of detail considering their nature. The main focus is to ensure that all costs are accurately recorded and reported to help the external stakeholders understand the overall cost structure and profitability. However, it doesn’t provide deeper insights because that is more relevant for internal cost management, which is not a concern in financial accounting. Financial accounting, on the other hand, helps in planning and controlling the company’s overall financial activities. Financial statements like balance sheets, cash flow statements, and income statements help directly deal with the external stakeholders to present the overall financial situation.

The legal standing of an organization is the factor that most starkly differentiates financial accounting from management accounting from a practical standpoint. The reports created by management accounting are exclusively distributed within an organization, while financial accounting can also be used externally. Producing information that may be put to good use inside an organization is the primary goal of management accounting, which is a subset of accounting. Business managers are responsible for collecting data that enables them to engage in strategic planning, assists them in establishing attainable goals, and facilitates the effective direction of corporate resources.

Managerial accountants create internal operational reports, while financial accountants create financial statements that, although also distributed internally, hold tremendous importance outside the company. They are generated using accepted principles that are enforced through a vast set of rules and guidelines, also known as GAAP. The information generated by the management accountants is intended for internal use by the company’s divisions, departments, or both.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Management accounting helps different departments in an organization to work in a coordinated manner.

People with the Certified Public Accountant designation have been trained in financial accounting, while those with the Certified Management Accountant designation have been trained in managerial accounting. Financial accounting reports are prepared for external communications and dissemination, while Management Accounting reports are generally developed with one part of the organization in mind. Financial accounting reports are developed from the basic accounting system, which is designed to highlight data about completed transactions.

In either case, developing your financial acumen is key to making better business decisions. Managerial accounting is important for drafting accurate and complete financial statements for internal use and crafting a company’s long-term strategy. Without good managerial accounting, corporate leadership can struggle to make appropriate choices or misunderstand the firm’s true financial picture. Because managerial accounting documents are not official, they do not have to conform to GAAP and can be used internally for a variety of purposes.