On this transaction, Cash has a credit of $3,600. This is posted to the Cash T-account on the credit side beneath the January 18 transaction. This is placed on the debit side of the Salaries Expense T-account. Recall that the general tax changes shake up salt deductions ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming. The general ledger is helpful in that a company can easily extract account and balance information.

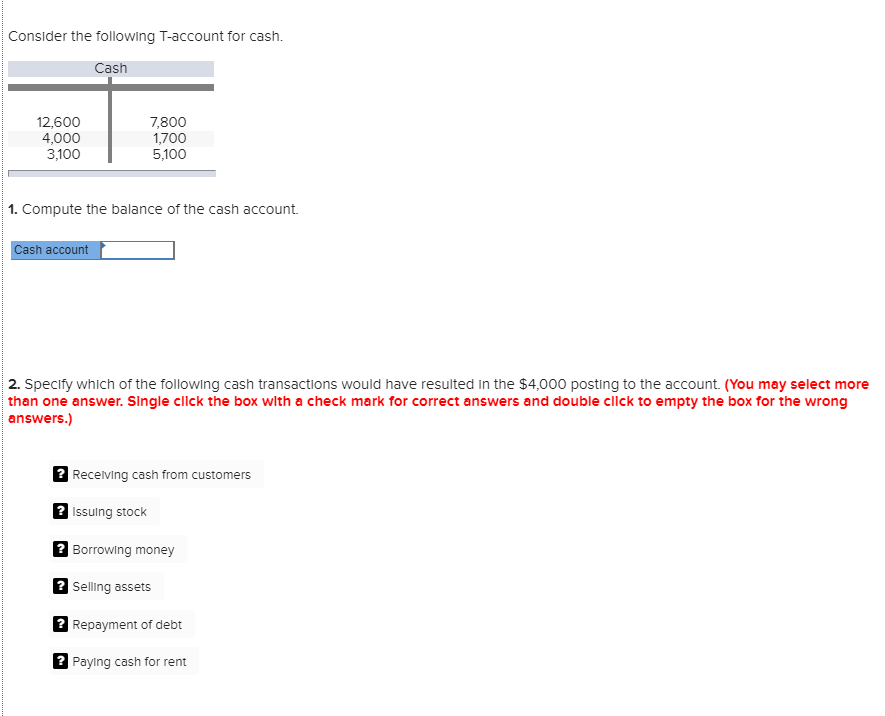

Compute the balance of the cash account.

LO 3.2Cromwell Corporation has the following trial balance account balances, given in no certain order, as of December 31, 2018. Retained Earnings at January 1, 2018, was $3,600. Using the information provided, prepare Cromwell’s annual financial statements (omit the Statement of Cash Flows). On this transaction, Cash has a credit of $3,500. This is posted to the Cash T-account on the credit side beneath the January 14 transaction.

Formatting When Recording Journal Entries

The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances. It is a good idea to familiarize yourself with the type of information companies report each year. Peruse Best Buy’s 2017 annual report to learn more about Best Buy. Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54. These reports have much more information than the financial statements we have shown you; however, if you read through them you may notice some familiar items.

Calculating Account Balances

LO 3.5Prepare journal entries to record the following transactions. LO 3.5Determine whether the balance in each of the following accounts increases with a debit or a credit. On this transaction, Accounts Receivable has a debit of $1,200. The record is placed on the debit side of the Accounts Receivable T-account underneath the January 10 record. The record is placed on the credit side of the Service Revenue T-account underneath the January 17 record.

Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction). The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record. When calculating balances in ledger accounts, one must take into consideration which side of the account increases and which side decreases. To find the account balance, you must find the difference between the sum of all figures on the side that increases and the sum of all figures on the side that decreases. Note that this example has only one debit account and one credit account, which is considered a simple entry. A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following).

- It is a good idea to familiarize yourself with the type of information companies report each year.

- On January 3, there was a debit balance of $20,000 in the Cash account.

- The next transaction figure of $300 is added on the credit side.

- You will notice that the transaction from January 3 is listed already in this T-account.

The date of January 3, 2019, is in the far left column, and a description of the transaction follows in the next column. Cash had a debit of $20,000 in the journal entry, so $20,000 is transferred to the general ledger in the debit column. The balance in this account is currently $20,000, because no other transactions have affected this account yet. LO 3.5Discuss how each of the following transactions will affect assets, liabilities, and stockholders’ equity, and prove the company’s accounts will still be in balance. Gift cards have become an important topic for managers of any company.

Understanding who buys gift cards, why, and when can be important in business planning. In the journal entry, Accounts Receivable has a debit of $5,500. This is posted to the Accounts Receivable T-account on the debit side.

With the process of bookkeeping, companies can track important financial information that helps management in making crucial decisions. Let’s look at one of the journal entries from Printing Plus and fill in the corresponding ledgers. Colfax Market is a small corner grocery store that carries a variety of staple items such as meat, milk, eggs, bread, and so on.