As a smaller grocery store, Colfax does not offer the variety of products found in a larger supermarket or chain. However, it records journal entries in a similar way. LO 3.5Journalize each of the following transactions or state no entry required and explain why. LO 3.4Identify the normal balance for each of the following accounts. LO 3.5Journalize for Harper and Co. each of the following transactions or state no entry required and explain why.

- This is posted to the Equipment T-account on the debit side.

- More detail for each of these transactions is provided, along with a few new transactions.

- You have the following transactions the last few days of April.

- In the journal entry, Equipment has a debit of $3,500.

f. Selling assets

LO 3.5Indicate whether each of the following accounts has a normal debit or credit balance. LO 3.2LO 3.4West End Inc., an auto mechanic shop, has the following account balances, given in no certain order, for the quarter ended March 31, 2019. Based on the information provided, prepare West End’s annual financial statements (omit the Statement of Cash Flows). On this transaction, Supplies has a debit of $500. This will go on the debit side of the Supplies T-account. You notice there are already figures in Accounts Payable, and the new record is placed directly underneath the January 5 record.

Posting to the General Ledger

This is posted to the Unearned Revenue T-account on the credit side. Analyze the following transactions using the T account approach. Place the dollar amount on the debit and credit sides.

OpenStax

We now return to our company example of Printing Plus, Lynn Sanders’ printing service company. We will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. Some of the listed transactions have been ones we have seen throughout this chapter. More detail for each of these transactions is provided, along with a few new transactions.

Issuing stock

In the journal entry, Cash has a debit of $20,000. This is posted to the Cash T-account on the debit side (left side). This is posted to the Common Stock T-account on the credit side (right side). Notice that for this entry, the rules for recording journal entries have been followed. You can see at the top is the name of the account “Cash,” as well as the assigned account number “101.” Remember, all asset accounts will start with the number 1. The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available.

LO 3.2Provide the missing amounts of the accounting equation for each of the following companies. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . You have the following transactions the last few days of April.

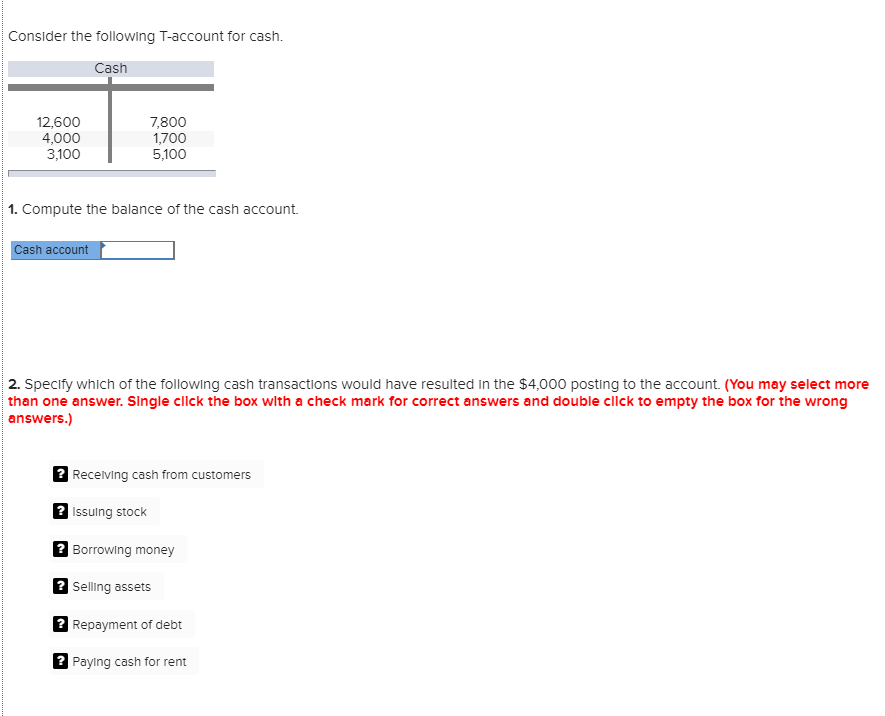

Accounts Payable has a debit of $3,500 (payment in full for the Jan. 5 purchase). You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record. Another example is a liability account, such as Accounts Payable, which increases when to use a debit vs credit card on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. Common Stock had a credit of $20,000 in the journal entry, and that information is transferred to the general ledger account in the credit column.

On January 3, there was a debit balance of $20,000 in the Cash account. Since both are on the debit side, they will be added together to get a balance on $24,000 (as is seen in the balance column on the January 9 row). On January 12, there was a credit of $300 included in the Cash ledger account.

Since this figure is on the credit side, this $300 is subtracted from the previous balance of $24,000 to get a new balance of $23,700. The same process occurs for the rest of the entries in the ledger and their balances. We know from the accounting equation that assets increase on the debit side and decrease on the credit side. If there was a debit of $5,000 and a credit of $3,000 in the Cash account, we would find the difference between the two, which is $2,000 (5,000 – 3,000).

LO 3.6Prepare an unadjusted trial balance, in correct format, from the alphabetized account information as follows. LO 3.1For the following accounts please indicate whether the normal balance is a debit or a credit. LO 3.2Consider the following accounts, and determine if the account is an asset (A), a liability (L), or equity (E). You can see that a journal has columns labeled debit and credit. The debit is on the left side, and the credit is on the right. Bookkeeping is the process of recording the financial transactions of a company on a regular basis.

LO 3.5State whether the balance in each of the following accounts increases with a debit or a credit. LO 3.4Identify whether each of the following transactions would be recorded with a debit (Dr) or credit (Cr) entry. Let’s look at the journal entries for Printing Plus and post each of those entries to their respective T-accounts. Another key element to understanding the general ledger, and the third step in the accounting cycle, is how to calculate balances in ledger accounts. LO 3.2Consider the following accounts and determine if the account is an asset (A), a liability (L), or equity (E).