A favorable variance may occur due to economies of scale, bulk discounts for materials, cheaper supplies, efficient cost controls, or errors in budgetary planning. James Woodruff has been a management consultant to more than 1,000 small businesses. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues. James has been writing business and finance related topics for National Funding, PocketSense, Bizfluent.com, FastCapital360, Kapitus, Smallbusiness.chron.com and e-commerce websites since 2007. He graduated from Georgia Tech with a Bachelor of Mechanical Engineering and received an MBA from Columbia University.

How do you calculate applied manufacturing overhead?

In the distance in the picture above, one can barely make out the smokestack that, for many years, loomed over Woodhaven. You can also see, on the front of the building, the word «Agate» — which was what Grosjean called his product (more on that later). Grosjean’s company was based on Pearl Street in Manhattan, manufacturing tin utensils, but after a few very successful years he required larger quarters. In 1863 he purchased an abandoned factory in Woodhaven and within a year, over 100 Woodhaven residents were employed at the factory. Here is what the factory looked like back then — the road at the bottom of the drawing is Atlantic Avenue. Our quality system ensures our child resistant caps, and our service to you, go above and beyond.

- Sometimes these are obvious, such as office rent, but sometimes, you may have to dig deeper into your monthly expense reports to understand what’s happening.

- Conversely, companies with more variable costs than fixed might have an easier time reducing costs during a recession since the variable costs would decline with any decline in production due to lower demand.

- There are other notifications you can receive by email or in the tool to alert you about activity and task reminders.

- Since it varies with production volume, an argument exists that variable overhead should be treated as a direct cost and included in the bill of materials for products.

- Now that we’ve defined the main types of manufacturing overhead cost categories, let’s look at 10 examples of fixed and variable manufacturing overhead costs.

PE 3 Machine

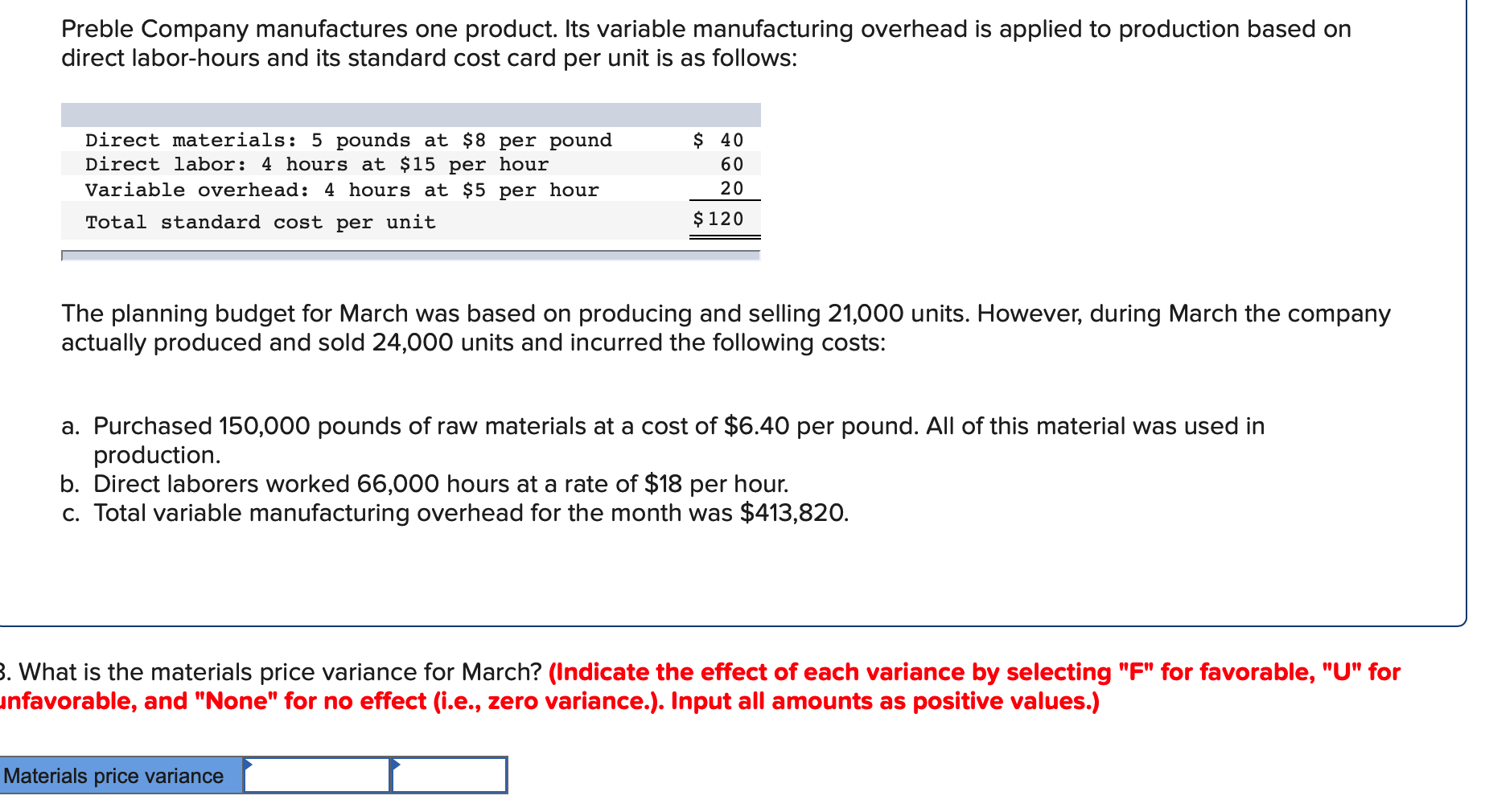

Costs such as direct material and direct labor, on the other hand, vary directly with each unit of output. Since Jerry’s uses direct labor hours as the activitybase, the possible explanations for this variance are linked toefficiencies or inefficiencies in the use of direct labor. Theright panel of Figure 10.9 contains some possible explanations forthis variance.

Example of Variable Overhead

Variable overhead efficiency variance refers to the difference between the true time it takes to manufacture a product and the time budgeted for it, as well as the impact of that difference. This is done by production managers so they can easily calculate their cost of goods sold and cost of goods manufactured. A predetermined manufacturing overhead rate can also be helpful when making a manufacturing overhead budget.

A variable overhead efficiency variance formula calculates the difference between the standard number of manufacturing hours expected to produce a unit and the actual number of hours that it took. Typically fixed overhead costs are stable and should how to upload your form 1099 to turbotax not change from the budgeted amounts allocated for those costs. However, if sales increase well beyond what a company budgeted for, fixed overhead costs could increase as employees are added, and new managers and administrative staff are hired.

Mastering Manufacturing Overhead: Keys to Cost Control and Profitability

To calculate your allocated manufacturing overhead, start by determining the allocation base, which works like a unit of measurement. Calculating manufacturing overhead is only one aspect of running an efficient and profitable project. You also need to closely monitor your production schedule so you can make adjustments as needed. Download our free production schedule template for Excel to monitor production dates, inventory and more. This not only helps you run your business more effectively but is instrumental in making a budget.

Johnson-VBC allows us to keep the same high standards in our custom designed and built closure lining and assembly products. The controller of a small, closely heldmanufacturing company embezzled close to $1,000,000 over a 3-yearperiod. With annual revenues of $30,000,000 and less than 100employees, the company certainly felt the impact of losing$1,000,000. If you have any comments, or would like to suggest other projects, drop us a line at or . The one thing that strikes us about the estate etching are the hills in the background. If that etching is accurate, it would have to mean that the area east of 96th Street near Atlantic were once hills that were somehow flattened when the houses in that area were built.

The overall operation costs—managers, sales staff, marketing staff for the production facilities as well as the corporate office—are known as overhead. If you do not have a clear financial picture of your overhead calculation, you will not be able to make well-informed decisions and that could be detrimental to your business. With a selling price of $155 and a total production cost of $93.60, the gross profit becomes $61.40 per pair, or a gross margin of 40% ($61.40 divided by $155). As mentioned above, you can track costs on the real-time dashboard and real-time portfolio dashboard, but you can also pull cost and budget data in downloadable reports with a keystroke.

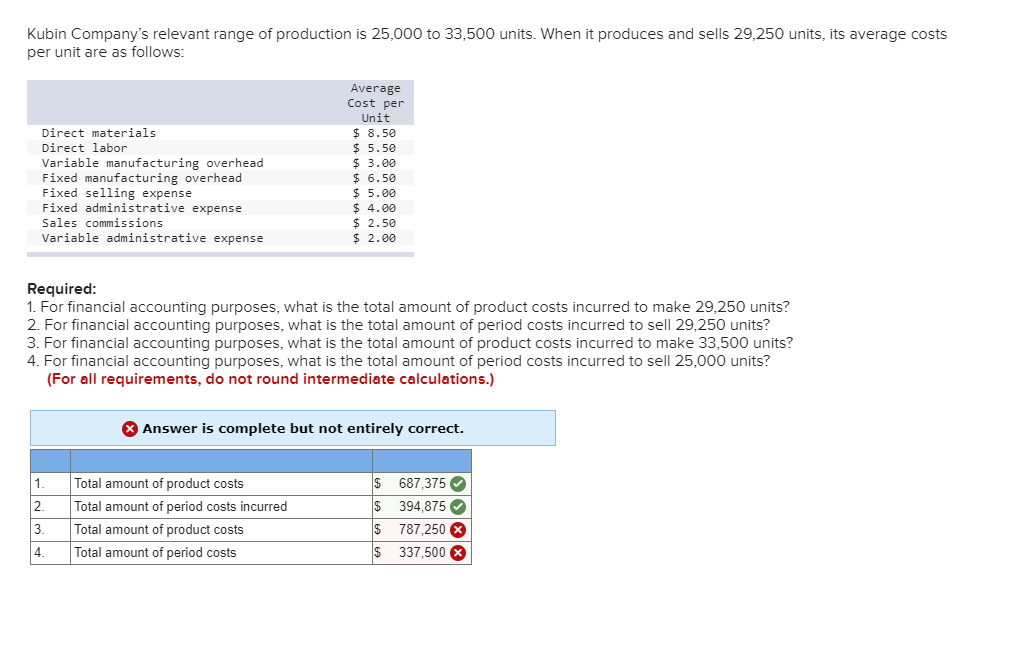

Overhead costs are indirect costs that cannot be directly traced to the production of a specific unit, but are necessary for the overall manufacturing process, such as utilities, maintenance, and indirect labor. If you’d like to know the overhead cost per unit, divide the total manufacturing overhead cost by the number of units you manufacture. To know the exact number of units to manufacture for the next quarter, make a production budget. Additional factors that may be included in variable overhead expenses are materials and equipment maintenance. As our analysis shows, DenimWorks did not produce the good output efficiently since it used 50 actual direct labor hours instead of the 42 standard direct labor hours. Variable overhead tends to be small in relation to the amount of fixed overhead.

And though it remained in business for many decades, and even prospered at times, it’s better days were effectively behind them shortly after the 20th century began. Who knows how this community would be different had Alfred Grosjean, or Auguste Cordier lived long enough to guide the company into the future. Here is the factory, looking a little more familiar to our eyes, though this picture was taken in the 1930s, when they were manufacturing Crusader Cookware.